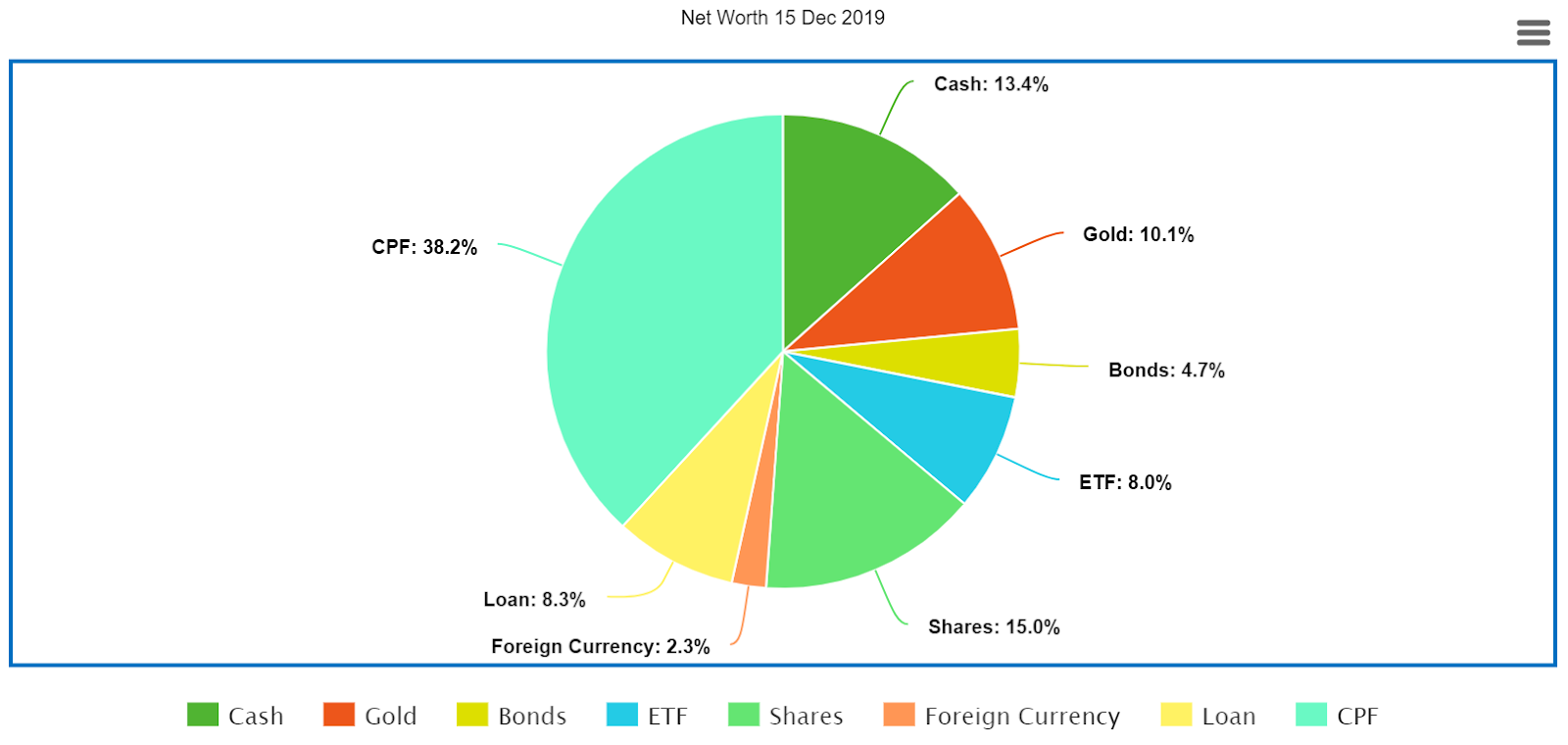

CPF: 38.2%

I have been transferring the funds from the Ordinary Account (OA) to Special Account (SA) and making voluntary contribution to the Special Account Retirement Sum Topping-Up Scheme. Thanks to the attractive interest rate, I have been getting more than $1000 in interest for the past couple of years. For now, I aim to max out the Medisave Account (MA) and hit the Full Retirement Sum in solely SA before building up funds in the OA which I plan to use it to purchase a property in future.

Shares: 15%

Consist of 8 cherry-picked local counters. Due to the recent bull, there's a nice gain in capital appreciation which helped to boost my net worth. Thus far, six counters are profit making, one counter is having a loss in capital but breaks even with the dividends, and another one is making a loss. I haven't dabble into overseas market yet as I'm still pretty clueless in that area.

Cash: 13.4%

The proportion will drop lower as I will be topping up the CPF in the last week of the year and I'm expecting a big expense coming up next year, so the money are just kept in the savings account. While I do feel a bit uneasy with not putting the money to work (not even in fixed deposit), I think it's not a bad move to have some cash sitting around waiting for better opportunities

Started buying some gold when gold price was low in the past years, the rocketed prices this year is also a major driver for the bump in my net worth. I'm regarding this as an emergency fund due to its high liquidity and the low purchase price, and with plans to liquidate it to invest in shares in case of a market crash.

Helped a friend to pay for his university fees. He's working part time and pays me back an agreed amount on time every month. I regard this as a long-term asset since this is not something I can get back within a couple of years.

ETF: 8%

Started investing in the ABF ETF Bond with the POSB Invest Saver Program when I first got a full time job. Still making a profit on this but I'm planning to sell it soon to have more investable cash at hand. May consider to buy some funds as diversification next year if the price becomes more attractive.

Bonds: 4.7%

Made up of Singapore Savings Bond and the Astrea IV Bond to diversify my portfolio and learn about bonds.

Foreign Currency: 2.3%

Just some leftover cash from overseas trips, and some amount in the YouTrip account

Try to top up in Jan and not Dec to earn a full year of interest and if you really don’t know what to do with your OA after you hit FRS and decided not to use it to buy a house, just top up your parents CPF and use it to buy additional annuities to boost their monthly payouts

ReplyDelete